OUR PRICE ADJUSTMENT DERIVATION ENGINE

Our proprietary price adjustment derivation engine is applicable to any industry that licences stock exchange trading data or 3rd party financial trading data from official venues and the OTC markets. Data is derived by integrating our engine with your raw market data feeds. This protects you from retrospective market data audits for non-compliance of licensing fees and policies.

EXCHANGES HAVE CHANGED THEIR DATA AUDIT APPROACH

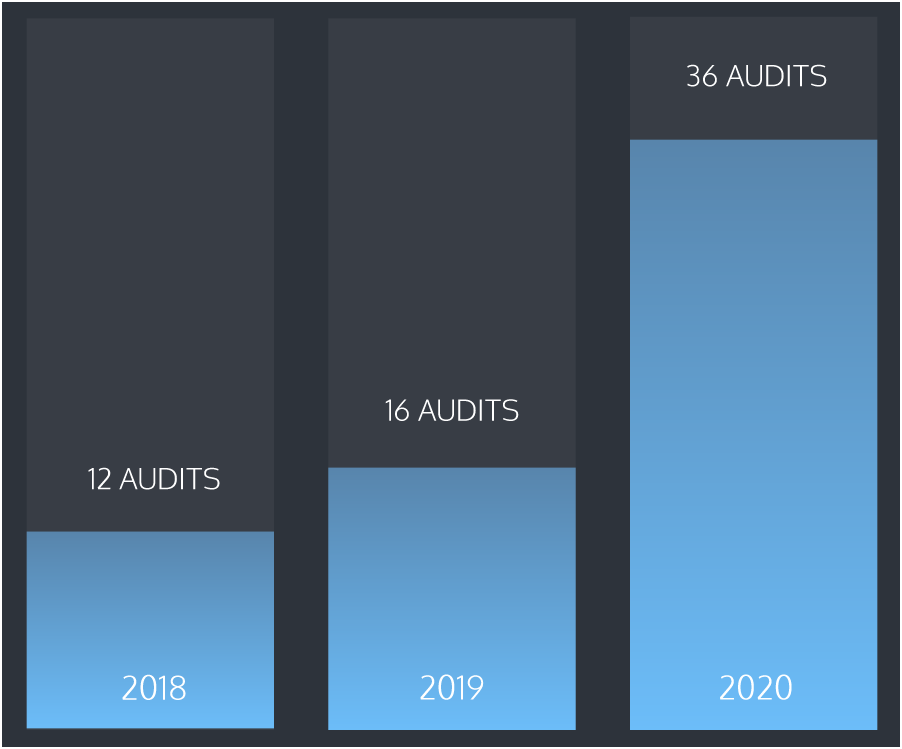

Previously a flat-fee Derived Data Licence Fee was sufficient and pre-audits were not undertaken. This has now changed; exchanges such as the London Stock Exchange and CME are undertaking pre-audits to ensure, prior to licensing, a firm’s derived data is not able to be reverse engineered and the onward distribution of data is licensed. The risk grows each year as more and more exchanges change their policies. The number of audits undertaken is increasing substantially year on year.

NON REVERSE-ENGINEERABLE

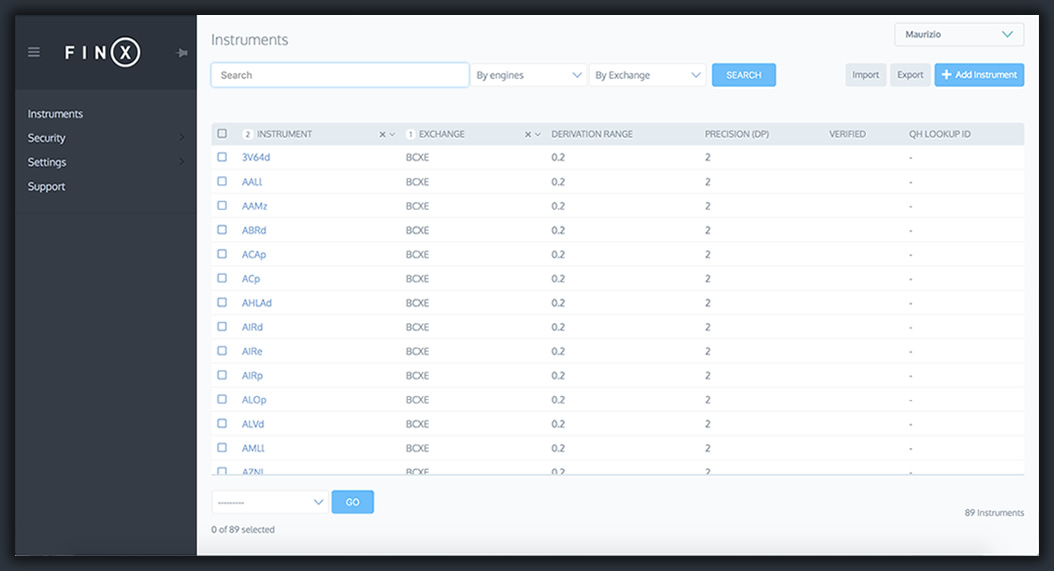

FinX gives you a neutral derived data feed, that cannot be reversed engineered by exchanges’ audits, allowing customers to add their own spreads and margins.

TYPICAL FLOW OF MARKET DATA

The derivations are aggregated with the prices within FinX before being sent into the aggregation engine as a maker:

UNDER THE HOOD

A price adjustment derivation engine works by making random adjustments to the value of each market in a trading data feed, creating a ‘derived data feed’.

Our engine injects this true randomness by using entropy pool methodology. An entropy pool is a source of random bits used to derive random numbers via a range of algorithms.

This offers a robust solution that cannot be reverse engineered; we have tested our engine’s derived feed against the reverse engineering policies of major exchanges.